Ordained Minister Housing Allowance

Ordained Minister Housing Allowance, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

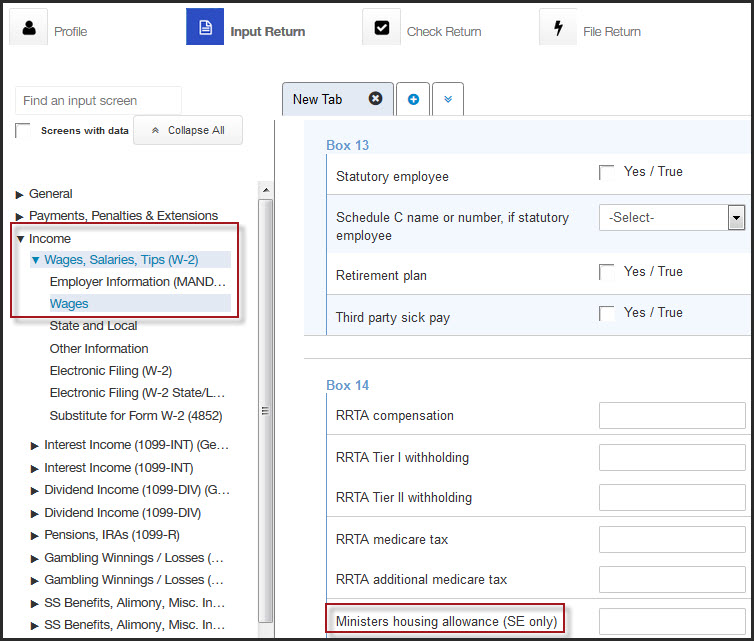

A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self employment tax purposes.

Nuclear waste disposal signs. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the. According to the irs the housing allowance exclusion is available to ordained commissioned or licensed ministers of a church with respect to services performed in the exercise of ministry in 2018 the uua received an opinion from an attorney with expertise on church regulatory issues that either fellowshipping or ordination satisfies this. This comes from revenue ruling 64 326 which allows for the housing allowance of an ordained minister to be paid by multiple churches.

How to determine what qualifies for the clergy housing allowance. These can cost hundreds of dollars and are difficult to obtain. In plain english the tax code prohibits a minister from claiming the housing allowance on any home other than the house that he occupies as his dwelling place a close review of the tax code and the regulations surrounding the ministerial housing allowance singly support the conclusion that the allowance can only be applied to the.

The ministers housing allowance is a very important tax benefit available to ministers. Speak to a subject matter expert at the irs. The housing allowance for pastors is not and can never be a retroactive benefit.

Traveling evangelists who are ordained ministers are eligible to take a housing allowance from the money given to them by churches located away from their community as long as it is designated in advance in writing and used to maintain a permanent home. There are only three ways to find out for sure if something qualifies. Missionaries are eligible for the housing allowance just as pastors are.

Get the irs to issue a private letter ruling regarding your specific situation. Only expenses incurred after the allowance is officially designated can qualify for tax exemption. The non profit approved a housing allowance for me last year of 4500 i am ordained minister and was given housing allowance last year approve by the board for 4500.

Therefore it is important to request your housing allowance and have it designated before january 1 so that it is in place for all of 2020. Traveling evangelists who are ordained ministers are eligible to take a housing allowance from the money given to them by churches located away from their home community. Section 107 of the internal revenue code allows ministers for tax purposes to exclude some or all of their ministerial income designated by their church or church related employer as a housing allowance from income for federal income tax purposes.

:max_bytes(150000):strip_icc()/GettyImages-175520675-83d7a74c00184d89aac2019cbb44e41b.jpg)